Delta Divergence refers to the phenomenon observed in order flow analysis, particularly when using footprint charts, where there is a discrepancy between the price movement of an asset and the underlying buying and selling pressure indicated by the delta. Delta, in this context, is calculated as the difference between the number of contracts traded at the ask price (buying pressure) and the number of contracts traded at the bid price (selling pressure).

Key Concepts

- Footprint Charts: These charts provide a detailed view of market activity at specific price levels, showing how many contracts were traded at the bid and ask prices. Each bar or footprint displays the volume traded, the delta, and the price action, offering insights into buyer and seller behavior.

- Understanding Delta:

- Positive Delta: Indicates that more contracts are being traded at the ask price, suggesting bullish sentiment.

- Negative Delta: Indicates that more contracts are traded at the bid price, suggesting bearish sentiment.

Delta Divergence Explained

Delta divergence occurs when there is a conflict between the price trend and the delta readings:

- Bullish Delta Divergence: This occurs when the price is making lower lows while the delta is showing higher values (indicating increasing buying pressure). This suggests that although prices are declining, the buying interest is strengthening, which could signal an impending reversal to the upside.

- Bearish Delta Divergence: This occurs when the price is making higher highs while the delta is showing lower values (indicating decreasing buying pressure). This suggests that despite rising prices, the buying interest is waning, indicating a potential reversal to the downside.

An Example of Delta Divergence and Confluence

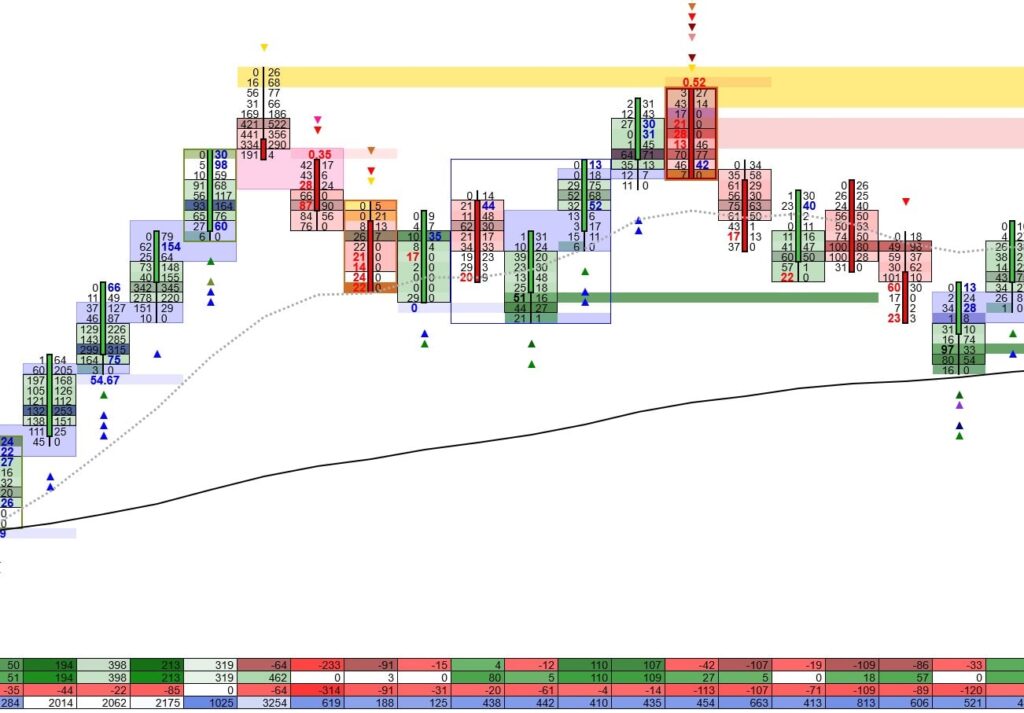

In the image below we can see on the 8 Range chart for the e-mini futures that we have an example of delta divergence show by the yellow horizontal strip. This is a higher high at the top of a upswing but the negative delta. More contracts have been bought aggressively on the bid (sold) than the offer (ask). This shows aggressive selling over buying and the price moves down. This can indicate that the swing higher is running out of steam and a reversal may occur.

What we can also see is 8 bars later we have a double top with multiple sell imbalances a stacked imbalance and a ratio bounds low plus zero prints on the ask.

The result was a downswing of 23 handles (points) and in the process crossing the 50 EMA. Confluence is the key whereby we have other technical factors that come in to play to give more confidence to the trade.

How to Identify These Turning Points

Traders can use delta divergence in conjunction with footprint charts to identify potential turning points in the direction of price. Here’s how:

- Observation of Divergence:

- Monitor price action in conjunction with delta readings on the footprint chart. Identify instances where price movements diverge from the delta trends.

- Confirmation with Volume:

- Look for additional confirmation through volume spikes or patterns in the footprint charts. A significant increase in buying volume at lower prices (in the case of bullish divergence) or selling volume at higher prices (in the case of bearish divergence) strengthens the signal.

- Contextual Analysis:

- Analyze the overall market context, including key support and resistance levels, recent news events, and market sentiment. This broader analysis can help validate the divergence signals.

- Execution:

- Once a divergence is identified, traders can prepare to enter positions in the anticipated direction of the reversal. This might involve setting limit orders or using stop-loss orders to manage risk.

- Risk Management:

- Employ sound risk management techniques. Since divergences can occasionally fail, it’s crucial to set stop-loss orders based on market structure to protect capital.

Conclusion

In summary, delta divergence in the context of order flow and footprint charts is a powerful tool for day traders. By recognizing discrepancies between price movement and delta readings, traders can identify potential turning points in market direction, allowing them to make more informed trading decisions. Integrating this analysis with comprehensive market context and robust risk management enhances the likelihood of successful trades in the dynamic E-Mini futures market.